About Course

Industrial Grease

Scope

-

Analysis of 4,749 patents related to industrial grease from 2010–2025.

-

Focused on inn

-

ovation trends, key players, technology areas, and market potential.

Key Findings

-

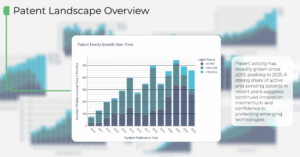

Explosive Growth

-

Patent filings show a 13.69% CAGR, indicating strong and accelerating innovation.

-

-

Technology Focus

-

Emphasis on lubricating compositions, multifunctional additives, and high-performance greases designed for extreme conditions.

-

-

Geographic Dominance

-

China leads globally, with Sinopec holding the highest number of patents, showing strong national leadership.

-

-

Market Potential

-

Patent activity suggests rising demand across automotive, manufacturing, and energy sectors, driven by performance and sustainability innovations.

-

Technology Trends

-

Growth in patent activity peaked in 2021 with sustained momentum.

-

Top IPC subclasses: C10M, C10N (lubricants and fuel compositions), mainly driven by Chinese innovation.

Strategic Recommendations

-

Policy Makers – Promote R&D in high-growth and sustainable technologies.

-

Investors – Target companies with strong IP and monitor new industrial applications.

-

Manufacturers – Adopt new technologies, invest in scalable solutions, and focus on circular economy practices.

Methodology

-

Data Collection – From WIPO, USPTO, EPO, and national patent offices.

-

AI & ML Analysis – Text mining, clustering, trend and network analysis, predictive insights.

-

Expert Review – Ensures accuracy and relevance.

-

Deliverables – Comprehensive PDF report + interactive dashboard.